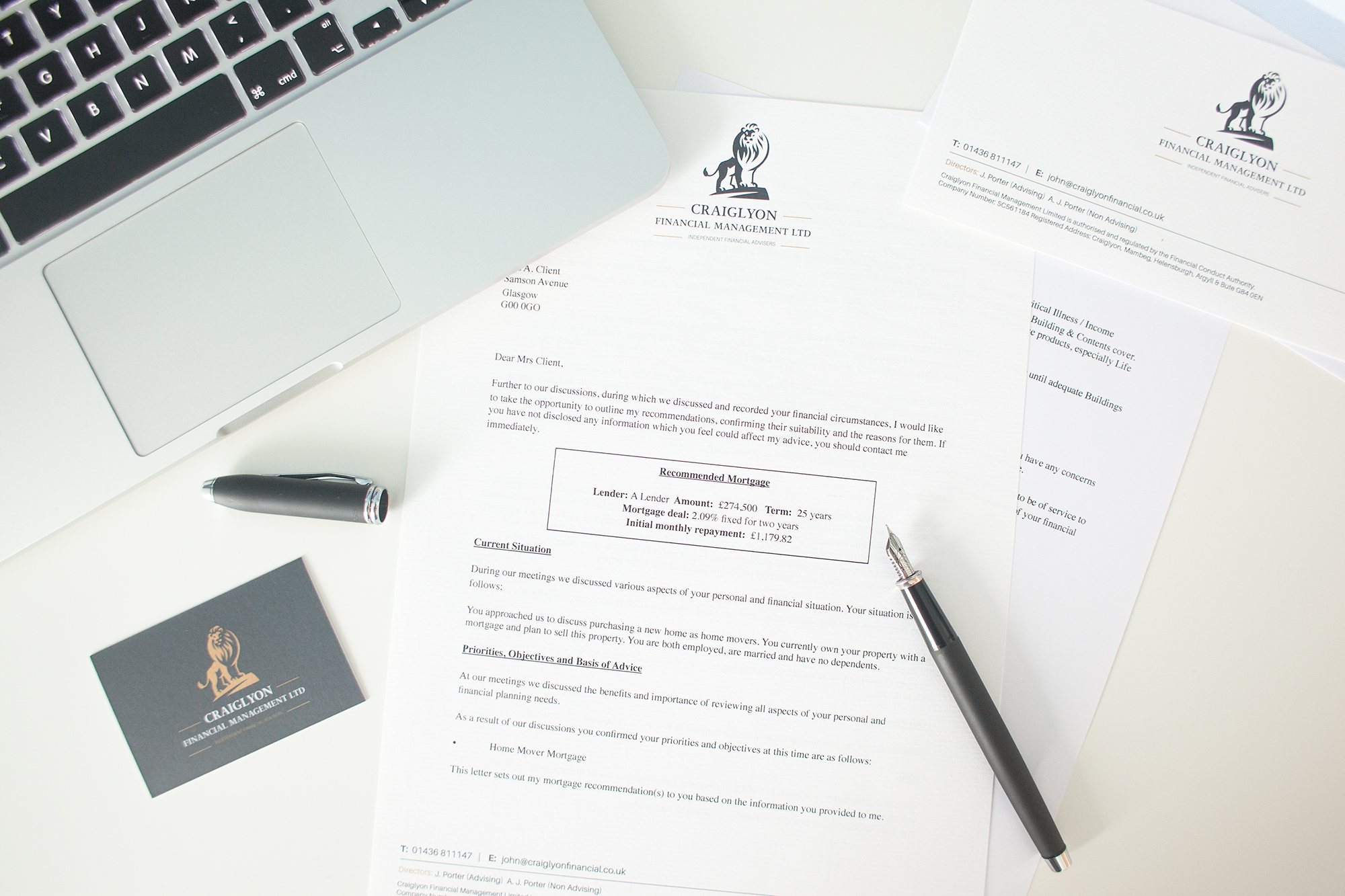

Mortgages

Whether a First Time Buyer or a seasoned homeowner or landlord, we have the ability to utilise the whole of the market within our research to find the best possible product for your needs. Our advice is completely independent and will take in to account your circumstances, as well as what you actually wish to get out of the product.

We cover all mortgage bases from the aforementioned First Time Buyer product, to Remortgages, Home Movers, Buy-to-Let landlords, Debt Consolidation and Additional Borrowing and Commercial Property loans.

Our mortgage advice process doesn't stop once we have found you a product. We will collect all the necessary documents, complete the application process and see the process through to completion by liaising with the lender and solicitors.

Our mortgage advice fee is made up of a £195 payment up front, as well as £300 to be paid when (and only when) your mortgage is offered.

The following, however, qualify for our no-fee mortgage application service:

Military personnel

First Time Buyers

Local council workers (teachers included)

NHS staff

Emergency service personnel

It is worth noting that while we do advise on Commercial property mortgages and buy-to lets, these are not regulated by the Financial Conduct Authority.

Please be aware that as a Mortgage is secured on your home, it may be repossessed should you fail to keep up mortgage payments.